外出して行うストレス解消法

世の中にはストレスを解消できる施設があるので、それらに出かけて思いっきり楽しんでみることを考えてみましょう。ここでは外出して行うタイプのストレス解消法を紹介するため、いろいろなことを楽しみたいなら参考にしてください。

映画を見てストレス解消

外出することがストレス発散になる人は、映画鑑賞がおすすめです。中でも感動したり泣けたりする内容のものは、特にストレス発散効果が高いといえます。その理由として人は感情のおもむくまま涙を流すことで、普…

温泉に行ってストレス解消

仕事や人間関係、家事育児などで毎日疲れ切っているという方もいるのではないでしょうか。どこにも出かけずにいると、毎日同じことの繰り返しでなかなかストレスを解消することができませんよね。そういう時は、…

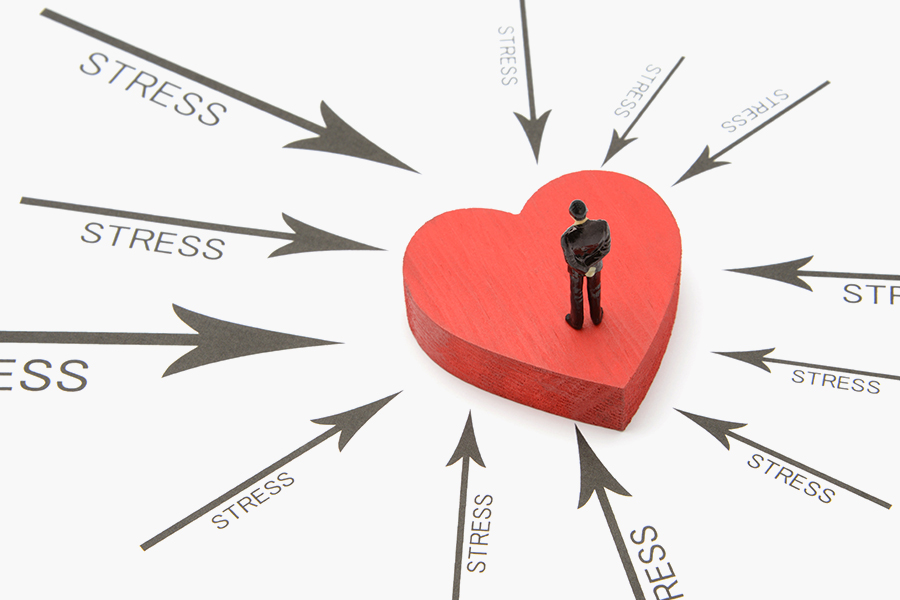

運動をしてストレス解消

ストレス社会といわれる現代では、メンタルの不調で休業や退職を余儀なくされる労働者が後を絶ちません。実際に行われた令和2年の実態調査では、メンタル面の不調が原因で過去1年間に休業や退職をした労働者の…